- NEWTON COUNTY APPRAISAL DISTRICT HOW TO

- NEWTON COUNTY APPRAISAL DISTRICT REGISTRATION

- NEWTON COUNTY APPRAISAL DISTRICT DOWNLOAD

NEWTON COUNTY APPRAISAL DISTRICT HOW TO

Keep in mind that property tax appeals are generally only accepted in a 1-3 month window each year.įor more information and example appeals, see how to appeal your property taxes. If you would like to appeal your property, call the Newton County Assessor's Office at (870) 446 2937 and ask for a property tax appeal form. If your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. Find assessor info on the county website. You will have to submit a form describing your property and sufficient proof that it is overassessed, including valuations of similar homes nearby as evidence. 14802 Newton Falls Ln, Sugar Land, TX 77498 is currently not for sale.

NEWTON COUNTY APPRAISAL DISTRICT REGISTRATION

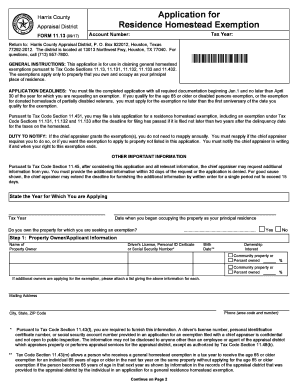

appraised at a value higher than the true market value of the property), you can attempt to get your home re-appraised at a lower value by contacting the Assessor's Office to submit a property tax appeal. The Newton County Board of Elections serves as the Superintendent of Elections for Newton County and is responsible for seeing that all voter registration and the conduct of elections comply with the laws, rules and regulations set forth in the Georgia Election Code and the Rules and Regulations promulgated by the State Election Board. If you believe that your house has been unfairly overappraised (i.e. Submitting a Newton County property tax appeal The Newton County Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in Newton County.Ĭontact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption, reporting upgrades to your home, appealing your property tax assessment, or verifying your property records. What can the Newton County Assessor's Office do for me? They reflect the base year value of a property as it stood on January 1 of that year, with any applicable changes as noted above.The Newton County Tax Assessor, Tax Collector, and Delinquent Property Taxes Office is located at 100 East Court Street in Jasper, Arkansas. Property Records Search for parcel information and property records through the County Assessors database.

Convenience Centers Find recycling centers in your area.

NEWTON COUNTY APPRAISAL DISTRICT DOWNLOAD

The assessed values shown on the parcel assessment search do not reflect current Find Find Court Forms Download forms for the Superior Court. Parcel assessment search to look up information on your parcel. The property owner must file an application within six months from the date that the catastrophic loss occurred. To qualify for a reduction in property assessment,

Pursuant to Pennsylvania law, property values may also be adjusted in the event of a catastrophic loss.Interim assessment on new construction or major improvements Occasionally, a school district or municipality requests an.Physical changes such as demolitions, subdivisions and.

0 kommentar(er)

0 kommentar(er)